Investing may seem like such a confusing thing to understand, but no more! Here is how to start investing for teens!

These tips will give you the knowledge to start investing in a matter of minutes.

By the way! You don’t have to be a teenager to read this. This advice is also extremely useful to college students in their 20s. Anyone can learn something new from this!

What is the Stock Market?

Stock Market (real definition): “A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses”

Here’s the definition for the people (like me) who can’t even comprehend what they just read:

The stock market is a place where companies can receive more money from someone like you, and in return, they will let you own a piece of their company.

Sounds pretty cool right?! You get to be an owner of multiple companies without even running anything!

Related Post: 10 College Dorm Essentials Everyone Needs

But Why Should I Invest as a Teen?

Well, when you become an owner/shareholder of a company, a couple of things will happen to your money:

- If the value of the company goes up, so does your money (and vice versa)

- You can receive compensation for investing in certain companies (dividends)

Dividends: A small payment given to its owners (that’s you!) every once in a while just for being an investor in their company

Here are a few more great reasons to start investing for teens:

- The stock market has increased 8-10% every year on average

- You will build up your wealth for retirement (boring I know, but very important)

- You can support companies you already love and use

- You’ll be financially ahead of all your friends

- Compound Interest

Example of Compound Interest: Let’s assume you make a 10% profit every year starting with $1,000. So after 1 year, you will now have $1100:

[(10% of 1000 = 100) (100 + 1000 = 1100)]Here’s where compound interest comes into play: After 2 years, you will now be making 10% profit on $1100 instead of $1000. So now you will have $1,210!

This multiplication allows your investments to grow exponentially instead of linearly as they age.

Related Post: 10 Money Saving Tips for College Students

What If I Don’t Have Enough Money to Invest?

Nonsense! You can start investing with as little as $5! So, instead of buying one more cup of coffee every week, turn that coffee money into your future wealth.

What Happens When I Invest?

1. Your money will be sent through an online platform of your choice (I will give you recommendations below)

2. That money will then be available to buy shares of companies

Share: A share is just a price tag of each companies stock. For Example: Amazon is currently worth $1,903.00 for 1 share.

If you think you can’t afford that, don’t worry. Certain apps and investing platforms allow you to buy a small fraction of the share.

3. You can choose to invest in companies of your choice with the money you have available

4. Or even better, you can invest in Exchange Traded Funds

Exchange Traded Funds (ETFs): A mix of a bunch of large companies that have more consistent and positive growth

5. You hold your money in the investments and watch them grow (Don’t touch them)

Investing in a large mix of companies can help beginners feel more comfortable about putting their money into the stock market because it is slightly less risky than buying individual stocks

It’s so important to grasp the concept of investing and you should always try to keep learning more and more about it, especially if you have investments.

Related Post: 10 College Hacks Every Student Should Know

Okay, I’m Convinced. When Should I Start Investing?

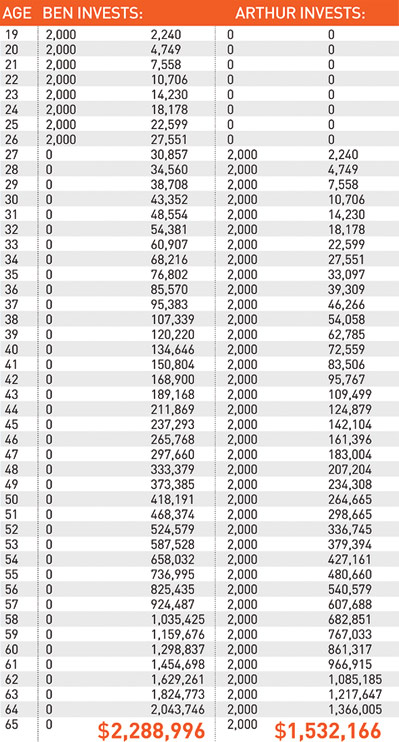

Now! If you don’t believe me, here’s a chart of what would happen if you invested earlier than later:

Arthur missed out on $756,830!!!

Yes, the average return every year in this chart is 12%, which is slightly higher than average, but you get the point. You can miss out on so much potential profit.

Please, be like Ben.

How to Start Investing for Teens Under 18 Years Old

If you’re not under 18 or a parent of a minor, you can skip this section.

If you’re a minor (under 18 years old), you have to open up a Custodial Account.

Custodial Account: An investment account opened up by a parent/guardian where a minor can invest in stocks while the account is responsibly managed by an adult.

I know, it sucks that you can’t do it by yourself as a teen, but it’s not the end of the world. In fact, it’s just the beginning and starting young will only make you more money in the future.

Parents Reading This!! Don’t miss out on the opportunity to start investing for teens to help them learn more about finance and put their money to good use. Help them… CONVINCE them, to open up a custodial account under your name!

Here’s A Link to the Best Custodial Accounts You Can Open

Do some proper research to make sure you know how much it costs to trade, if there are any minimums to start, or if it’s the right fit for your purpose.

How to Start Investing for Teens Over 18 Years Old

Being an adult has a lot of advantages when it comes to investing. One being that you can do it all by yourself!

There are plenty of apps out there that allow you trade stocks. These are a few of my favorites:

1) Acorns

Acorns is what I use for most of my investments. These are a few benefits of investing with Acorns:

- You can invest with as little as $5

- It is completely free for students and only $1/month if not

- It rounds up and invests your spare change for you. Ex: You buy a $4.50 coffee. Acorns rounds that to $5.00 and invests the left over $.50 cents

- You can choose how aggressive you want your portfolio

- Acorns does all the investing work for you while you watch the money grow

If you’d like, you can use this link to sign up for acorns and get a free $5 investment that you can withdraw at anytime! I will receive $5 as well if you use my link at no additional cost to you.

2) Robinhood

Robinhood is great investment app for investing in individual stocks that you’re passionate about. Here are a few benefits to using Robinhood:

- Free stock trading with no hidden fees of any kind

- You can invest in individual stocks and cryptocurrency

- Daily news on the app of companies and how they’re doing

- You can now invest in fractional shares

- No minimum to get started

You can use this link to sign up for Robinhood and receive 1 free stock valued up to $100.

3) Fidelity

Fidelity is a very large company that now has no trade fees and includes lots of informative company insights. Here are a few benefits to using Fidelity:

- $0 commission trades

- No minimum to start investing

- Easy and useful tools for learning

- Real branches to go to for consultation and assistance

You can learn more about them here.

Related Post: 5 Ways to Make Money as a Teen

What Do I Do When My Money Goes Down?

Don’t panic. The stock market has ALWAYS recovered from going down in the long term. Hold your investments. Don’t take them out. Dips in the market are usually followed by rising stocks.

Instead, continue to learn more about why the market goes up and down. Continue to invest consistently and eventually you will grow your wealth.

Hopefully this guide on investing for teens has helped you get started in the stock market. Don’t forget to come back to refresh your memory and receive some advice on investing!

If you have any comments or questions, leave them down below. Thanks for reading!

2 comments

Whats your opinion on Robo-Advisors Daniel. I’ve invested thousands and made hundreds with Robo-Advisors at the age of 16 but I’m wondering if there’s a better option for the long term investment goals I have. (100k by age 25).(I’m investing half of my paychecks in a roboadvisor)

Spencer I have to say… you’re a very impressive teenager. You have goals that 30 year olds are just now thinking of. I like Robo-Advisors a lot (I use one for most of my investments as well). Long term I actually believe it’s one of the better options because it reduces the urge to invest in smaller stocks and get caught up in all that day trading mess. If you can make it a goal to invest half your paycheck at any age moving forward, you’ll be making more than 100k at 25!