Just got your first job as teen? Don’t know how to budget your money? How much should a teenager save from a paycheck? Let’s find out!

If you’re finally making a decent income as a teenager, you’re probably interested in a reasonable savings goal.

Every teen will have different financial situations which you should definitely account for when deciding how much to save.

Let’s answer some of those savings questions!

Why a Teenager Should Save Money From a Paycheck

No matter what age you are, saving will always be a recommended strategy for financial success in life.

Saving money as a teenager comes with a ton of benefits:

- Builds financial independence

- Teaches you the value of money

- Helps build up money for big purchases

- Reduces stress

- Increases wealth over time

- Avoids impulse purchases

It’s more than just saving for that new gaming setup or make up set. It’s about teaching yourself financial literacy for future success!

Again, everybody will have different goals. You might not care about building up a financial base for yourself at such a young age.

I get it… it sounds boring and you probably just want to have fun as a teen. Keep in mind, people with less savings were more stressed out on average.

There’s definitely a way to have fun with friends while still saving money. Plus, you can adjust your budget to fit those things into your lifestyle!

How Much Should a Teenager Save From a Paycheck?

It is recommended that a teenager saves at least 20% of their money from a paycheck. Open a savings account and automatically transfer 1/5 of your money every time you get paid.

The rest of your money should be placed into a checking account which you can use to spend on any expenses you may have.

Ask your parents to open up these accounts (if they haven’t already) so that you can start managing your money as a teenager.

Some teenagers won’t be able to save 20% while others will be able to save nearly 80% of their paycheck.

You need to adjust your savings percentage based on your necessary expenses. These expenses usually vary based on your age as well.

Take a look at the different age ranges….

How Much A Teenager Should Save From a Paycheck At Every Age

Every teenager should save a different amount based on their age and financial situation.

Here are the recommended savings percentages for each age:

- 13 Year Old – 80%

- 14 Year Old – 70%

- 15 Year Old – 70%

- 16 Year Old – 50%

- 17 Year Old – 50%

- 18 Year Old – 30%

- 19 Year Old – 20%

Going from 15 to 16 and from 17 to 18 are the largest jumps because of major life changes such as car costs and college expenses.

All in all, these are good minimums to follow. If you can save more, fantastic!

If not, try your best to save as much as your lifestyle allows.

How Much of a Paycheck Should I Save in High School?

You should save about 50% of your paycheck in high school.

You likely won’t have many expenses as a high school student so you can get away with a higher savings percentage.

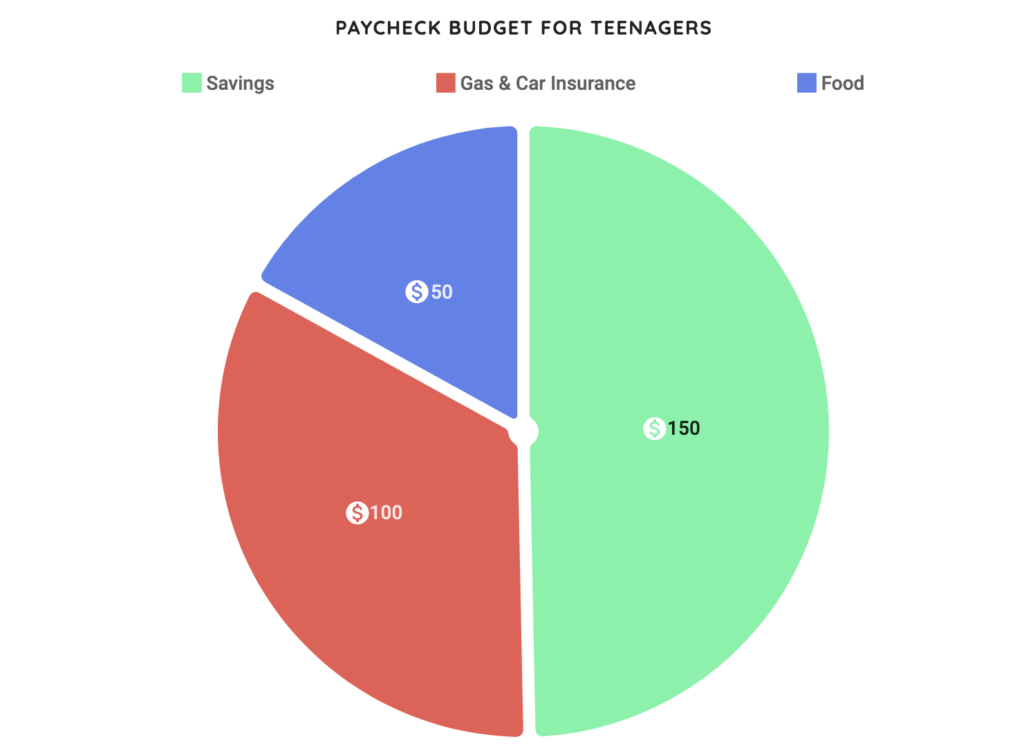

Let’s say you make $300 every 2 weeks after taxes…

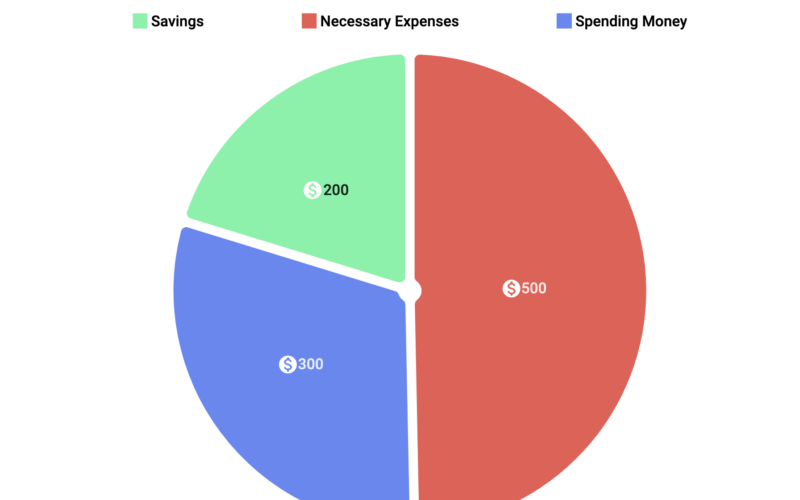

Here’s an example paycheck budget for teenagers who are older than 16 and have necessary car expenses.

Now, let’s say your gas and car insurance costs more money than $100. You have 2 options…

- Reduce your savings

- Reduce your other expenses

Keep in mind that your $100 budget for car expenses is actually $200 per month (because the $100 is only for 2 weeks).

If you’d consider yourself a frugal person, you might want to reduce your other expenses to make up for your car expenses.

If you really enjoy having that extra money for food, shopping, or anything else, then you can reduce your savings to 40% (for example) to make up for your car expenses.

You might also have more categories that need to be divided up, which is why it’s normal for teenagers to have very different budgets!

How Much of a Paycheck Should I Save in College?

College is a whole different beast to deal with when it comes to saving.

You’ll probably be the most broke you’ve ever been, especially if your family doesn’t help out with expenses.

Knowing how to save money in college is not easy, but with the right practices and budgeting, it’s definitely achievable.

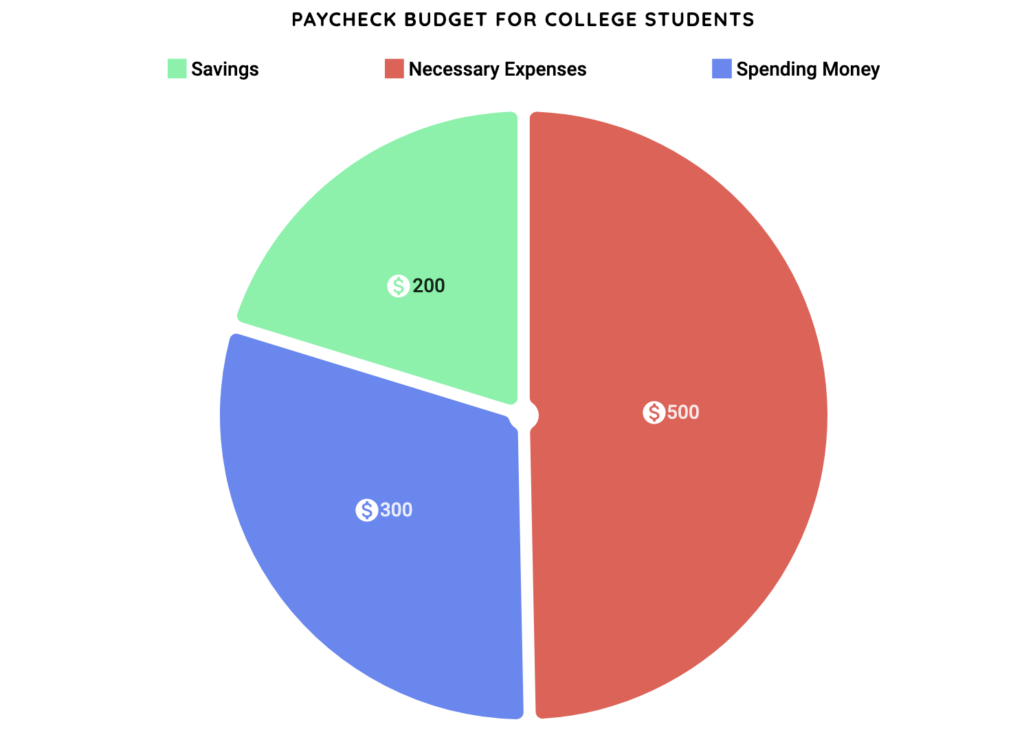

Aim to save about 20% of your paycheck income after taxes. This will be enough to build up a stable emergency fund while still covering other expenses.

At 18 and 19 years old, you might have a slightly better job which can definitely help offset the extra expenses.

Let’s assume you make $1,000 every month after taxes…

This chart follows a common budgeting rule known as the 50/30/20 rule. Here’s how it works:

- 50% of Income Goes Towards Necessary Expenses

- 30% of Income Goes Towards Wants

- 20% of Income Goes Towards Savings

As a college student, you’re almost guaranteed to have a different budget than the person right next to you. It’s crucial that you adjust based on your expenses!

How Should A Teen Budget for Money?

Luckily, as a teen, you don’t have too many expenses that will eat away at your paycheck every couple of weeks.

That’s why saving your money (and saving as much as possible) should be a priority.

Here are 5 steps for teens to budget for money:

- Calculate your monthly income

- Calculate your monthly expenses

- Divide your expenses into categories

- Choose a savings percentage (what percentage you want to save)

- Make a budget worksheet (to stay on track)

Let’s make an example budget!

1) Calculate Your Monthly Income

Gather all your income sources, whether that be from a job, allowance, entrepreneurial work, or anything else.

Let’s say you add everything up and come to $500 per month.

Great! You’re done with the first step. NEXT!

2) Calculate Your Monthly Expenses

Gather all your expenses – video games, shopping, eating out, bowling with friends, literally everything.

You may have never done this before, so use these next 30 days to write down every single thing you spend money on and exactly how much it costs.

Once you’ve added them up, you’re going to find that you barely spend any money, OR you’ll find that it’s time to start cutting down on expenses.

For the sake of this example, let’s say you spend about $200 per month on average.

3) Divide Your Expenses Into Categories

Dividing up your expenses into different categories will help you understand where you’re spending the most in order to cut down in those areas.

Here are a few expense categories for teenagers:

- Car payments

- Phone bill

- Eating out

- Entertainment (bowling, video games, movies, etc.)

- Subscriptions

- Beauty/Skincare

- Clothing

You can also add more personal categories such as “soccer club fees” or “gifts for sister”.

Make it your own and divide anything you can think of. For your first month, try listing every single expense down separately and then place them into categories later.

4) Choose a Savings Percentage

To choose a consistent savings percentage that works, you have 2 options…

- Pick a percentage that fits your expenses

- Pick a percentage and make your expenses fit

I preferred option #2 as a teenager and you might too if saving money is fun for you!

For example, you might subtract your expenses from your monthly income and just consider the leftover money as savings.

In this scenario, our monthly income was $500 and our monthly expenses were $200…

$500 – $200 = $300 (60% savings) – Option 1

Decide on saving 50% of income: $250 – Option 2

At first, it might look like option 1 is more admirable, but keep in mind that every month might be different.

If one month you wanted to spend $300, you’re now left with $200 in savings (or 40%) which is less than your set rate of 50% in option 2.

The choice is really up to you, but try to limit your expenses so that you’re saving at least 50% when possible.

5) Make A Budget Worksheet

A budget worksheet will help you stay on track, manage your expenses, and learn where your money is going.

Here’s an example budget worksheet for teenagers:

You can download this Budget Worksheet for Teenagers here!

Fill it out every month as you go and set goals to save more and more when you can. That’s it!

As long as you actually stay on top of filling out this worksheet, you’ll become familiar with your finances and ultimately budget your money!

How Much Should A Teenager Spend Per Month?

A teenager should spend no more than 50% of their money on things they want. A good rule of thumb is to save at least 20%, spend 50% on necessary expenses, and 30% on wants.

Spending more than 50% of your money can result in poor spending habits as you get older.

Save as much as you can and you’ll slowly get better at decision making for things you want to buy yourself.

What Should I Do With The Money I Save?

You have 3 main options as a teenager:

- Save for emergencies (car repairs, computer breaks, etc.)

- Save for a large purchase (gaming setup, car, house, etc.)

- Invest your money (to build long term wealth)

If you don’t have an emergency fund yet, definitely work on that first! You want to save up at least 3-6 months worth of expenses in a savings account.

Saving up for a car or another big purchase? Make a savings goal every month and try to reach your end goal by a certain date.

Do the math to figure out how many months you’ll need to save to eventually spend on a large purchase.

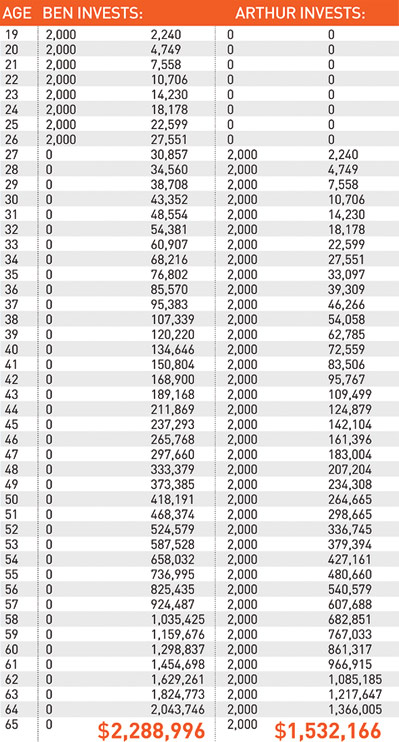

Last, but certainly not least, is investing.

How to Invest As A Teenager

Investing your money in the stock market is by far my favorite way for a teenager to save from a paycheck!

You can build a ton of wealth starting at such a young age, especially if you have a decent amount of savings to consistently invest.

The earlier you start, the better! Take a look…

Ask your parents to set up a custodial account so that you can start investing as a minor. If you’re over 18, you can set up your own brokerage account.

If you know absolutely nothing about investing, start learning now!

I highly recommend the Acorns app for anyone over 18, especially in college, who wants to invest but doesn’t know what stocks to invest in!

It essentially invests your money for you without having to do any research into stocks. Plus, you can choose how aggressive you want your portfolio to be.

Conclusion

Hopefully you’ve learned more than just how much should a teenager save from a paycheck and can start building wealth early on.

Be sure to account for your own personal situation. Everyone will have a different rate at which they can save, earn, or spend their money.

How much money do you save as a teenager?

If you have any comments, questions, or suggestions leave them down below. Thanks for reading!