Across the United States, the familiar rhythm of mall life is thinning out. Anchors that once pulled in families on Saturdays now sit with blocked entrances and clearance banners that never seem to come down. Teen hangouts look quieter, food courts turn over faster, and long-running chains quietly vanish from mall directories. By 2026, many centers will feel more like patchwork experiments than polished shopping temples, holding a mix of nostalgia, empty space, and a few stubborn survivors.

JCPenney Losing Its Last Strongholds

For generations, JCPenney marked the safe middle of American shopping, with school clothes, towels, and holiday photos all under one roof. Years of missteps and a bruising bankruptcy have left a much smaller chain and a shrinking list of leases worth renewing. As more locations go dark, many midtier malls will lose their last traditional department store, leaving one side of the building oddly quiet and heavy with memory.

Macy’s Pulling Back To Richer Zip Codes

Macys still carries emotional weight as the classic name on gift boxes and parade floats, but the business is tightening its circle. Store closures have hit underperforming malls hardest, especially in regions with softer sales and aging infrastructure. The brand is pouring more energy into flagship sites and lifestyle centers, not struggling enclosed properties. As those decisions stack up, many everyday shoppers will find their nearest Macys replaced by blank glass and leasing banners.

Sears Existing Mostly As A Memory

Sears helped invent the modern mall anchor and then slowly became a time capsule inside it. The remaining stores often feel frozen, with old fixtures, scattered shoppers, and entire aisles sitting bare. Each new closure turns another wing into a redevelopment puzzle for landlords who now think more about storage, clinics, or gyms than refrigerators and socket sets. By 2026, Sears will live on mostly in catalogs saved by grandparents and half-faded signs on forgotten walls.

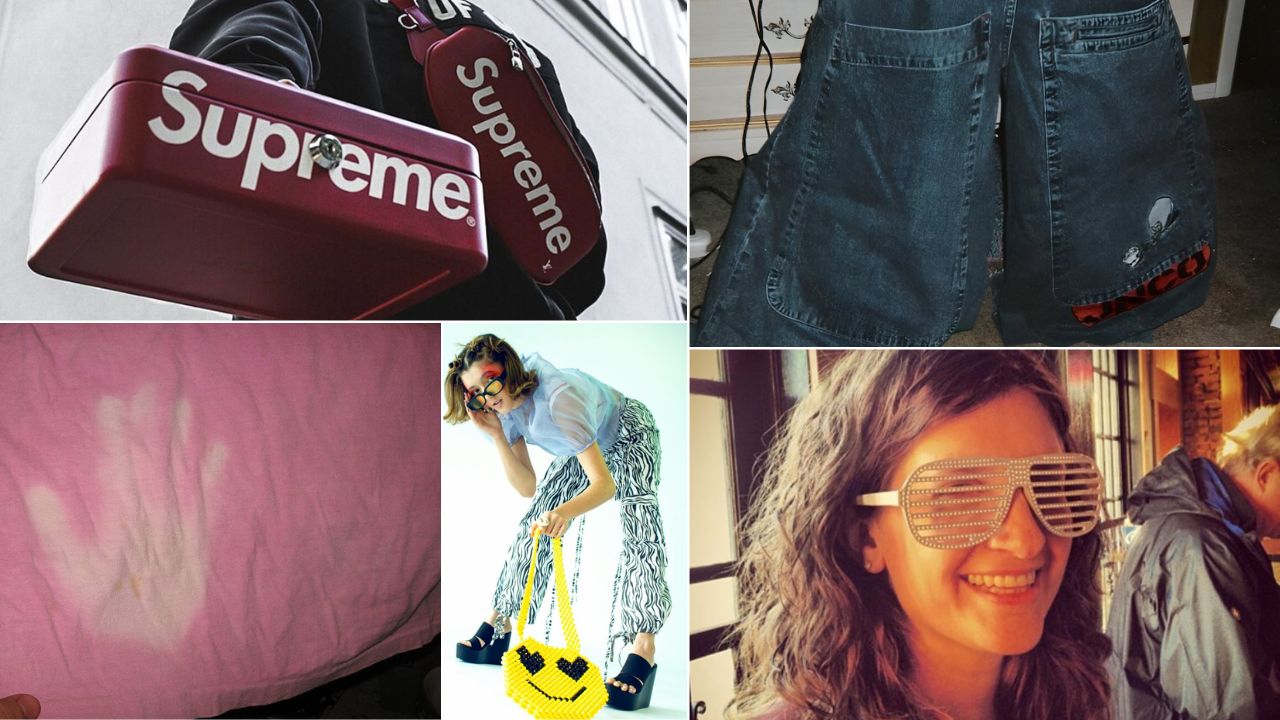

Forever 21 Letting Go Of The Big Boxes

Forever 21 once pulsed at the center of teen life, with fast fashion, loud music, and mirrors that saw countless group selfies. The economics no longer favor huge multi level spaces packed with low margin trends, especially as online shopping claims the quickest impulse buys. Large footprints that once felt exciting now weigh on balance sheets and leasing talks. As these stores vanish, many malls lose a loud, youthful engine and gain an awkward empty shell.

Express Shrinking Its Office Wear Presence

Express reliably dressed early career workers for first interviews, casual Fridays, and nights that blurred into mornings. The shift toward hybrid work, looser dress codes, and cheaper online options has cut deeply into that niche. Leadership has responded by trimming locations and chasing selective upgrades rather than broad mall coverage. As leases roll off through 2026, a growing number of centers will miss that polished window of blazers, party dresses, and confident mannequins.

Foot Locker Moving Beyond The Mall Grid

Foot Locker framed sneakers as small trophies lined up under bright lights, turning quick visits into mini rituals for many kids and teens. Now the brand is steering energy toward street locations, power formats, and digital drops that do not rely on aging concourses. In older malls, stores quietly close when leases expire, leaving only the memory of shelves stacked with signature releases. The sneaker culture survives, but it drifts farther from the typical mall map.

GameStop Letting Go Of Trade In Counters

GameStop once made malls feel like clubhouses for gamers, full of preowned stacks, midnight launches, and lively arguments by the register. Digital downloads, cloud subscriptions, and shifting hardware cycles have stripped away much of that daily foot traffic. Smaller, leaner formats make more sense than a dense national mall network. As more locations close by 2026, the familiar sight of game walls glowing across from the food court will become surprisingly rare.

The Body Shop Leaving Behind Green Storefronts

The Body Shop brought a different tone to the mall, mixing activism, fair trade messaging, and bold scents in small glass jars. Financial trouble and restructuring have already erased many of those green storefronts from local centers. Where they disappear, there is usually no perfect one for one replacement, only another bath and beauty chain with less history in ethical messaging. For shoppers who grew up on those signature fragrances, the absence feels personal.

FYE And Media Stores Slipping Into Nostalgia

Entertainment retailers like FYE once gave malls a soundtrack, with stacks of CDs, DVDs, posters, and band tees spilling across every wall. Streaming and instant digital libraries have hollowed that model out, turning physical media into a niche rather than a necessity. Surviving stores lean heavily on collectibles, but that pivot does not justify every mall lease. As more close, browsing for music and movies in person becomes a rare, nostalgic side quest instead of a weekend habit.

Bath And Body Chains Drifting To Open Air Centers

Bath and body brands still sell out seasonal candles and lotions, but they are more selective about where those lines run. Traffic rich lifestyle centers and outdoor plazas draw stronger numbers than quiet enclosed malls struggling for relevance. As companies relocate stores to open air formats, certain malls lose a reliable source of steady foot traffic and impulse gifting. The air feels different without that steady cloud of fragrances hanging over center court.

Mall Movie Theaters Dimming Their Screens

Attached multiplexes once turned malls into full day destinations, where shopping blurred into showtimes and late snacks. Streaming platforms, shifting release windows, and rising operating costs have strained many of these locations, especially in underperforming centers. When a theater closes, it leaves behind a large, oddly shaped shell that is hard to repurpose quickly. The loss reaches beyond revenue, taking with it one of the last shared ritual experiences that kept evenings lively.

Casual Dining Chains Vacating Corner Pads

Casual dining chains tucked near mall entrances used to host birthday dinners, sports nights, and long gossip sessions over shared appetizers. Slower mall traffic, higher wages, and rising food costs have knocked the shine off many of those locations. Some brands pivot to smaller footprints or focus on delivery and standalone sites, leaving their mall adjacent pads dark or under construction. What remains inside is a quicker style of eating that rarely lingers over bottomless drinks.